With SCENARIO X’s V.I.S.I.O.N. system, visualize the future of your financial landscape by integrating diverse data sources. Synthesize complex information streams to innovate solutions that optimize performance and navigate market challenges with unparalleled precision. Adopt our platform for a visionary approach to managing and forecasting in the finance sector.

With SCENARIO X’s V.I.S.I.O.N. system, visualize the future of your financial landscape by integrating diverse data sources. Synthesize complex information streams to innovate solutions that optimize performance and navigate market challenges with unparalleled precision. Adopt our platform for a visionary approach to managing and forecasting in the finance sector.

Empowering financial institutions

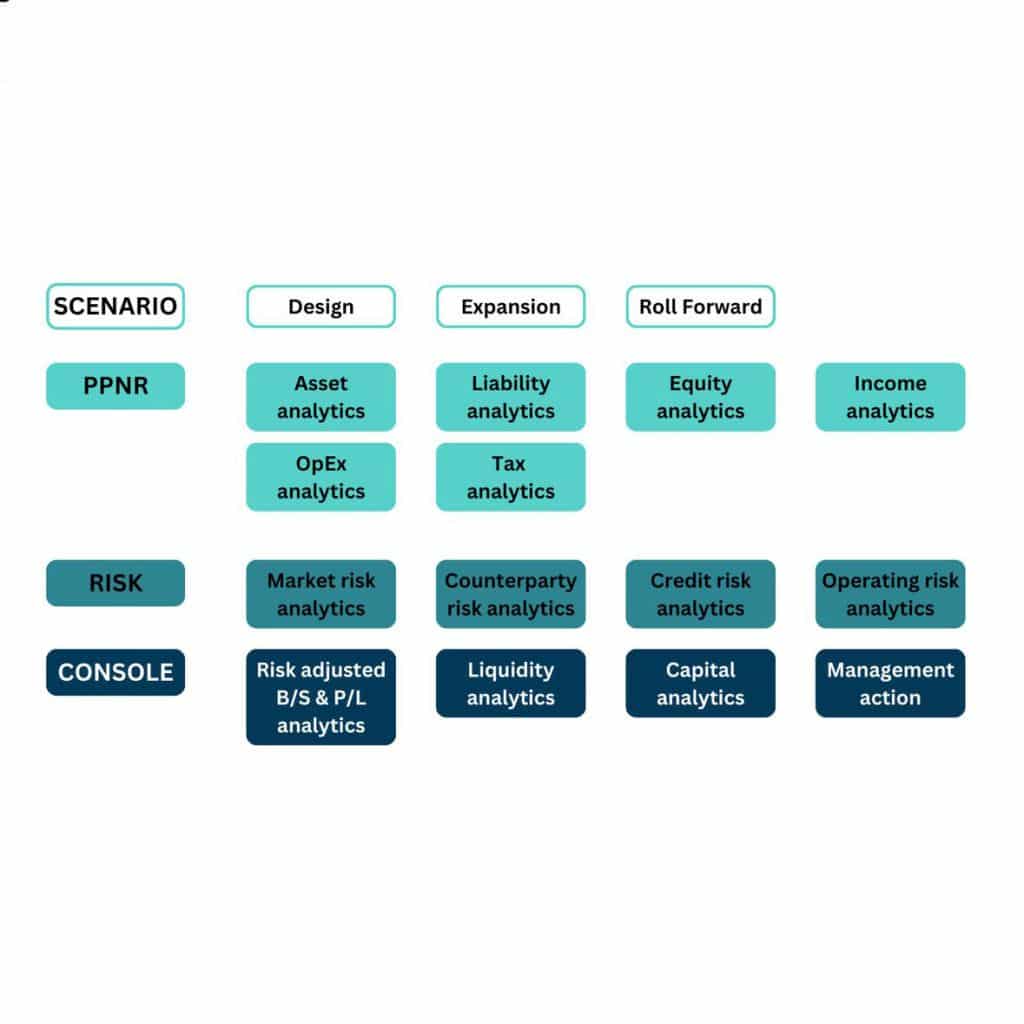

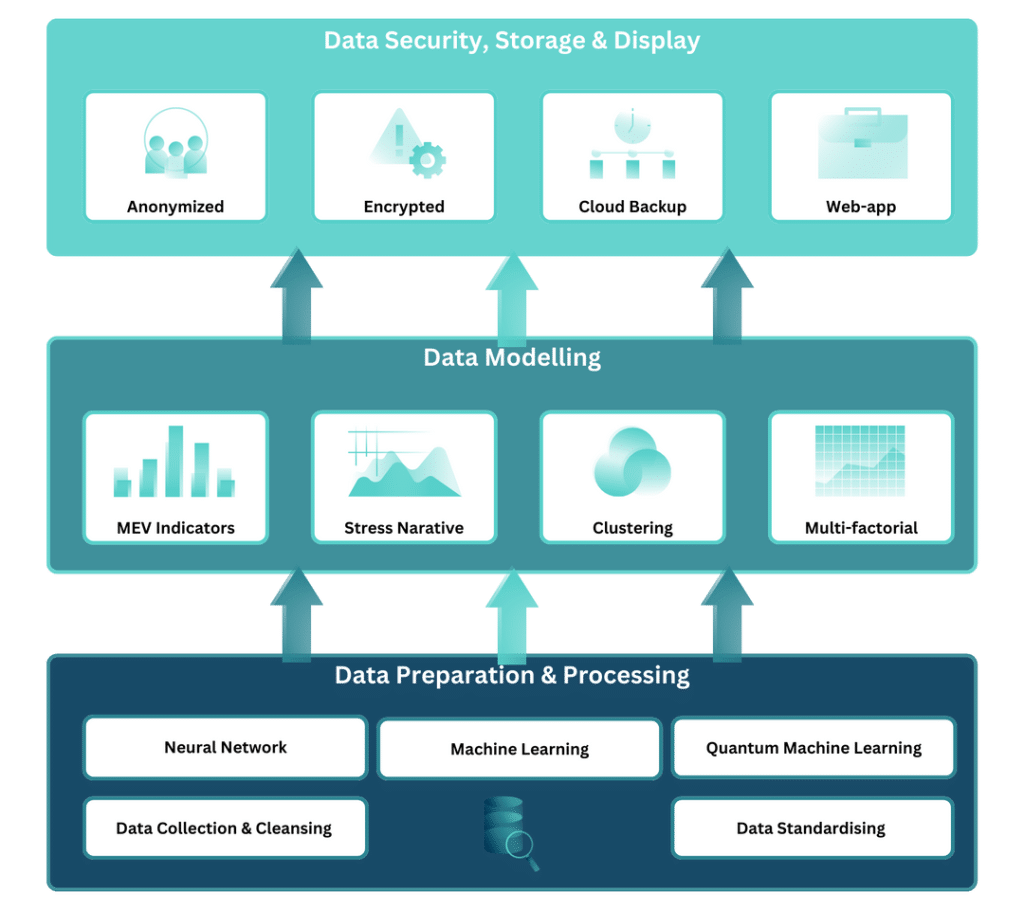

SCENARIO X is reshaping the landscape of scenario-based modelling with its advanced, integrated platform tailored specifically for financial institutions focused on refining their risk management and stress-testing processes. Our solution, supported by over 15 core interconnected modules, spans a comprehensive range of functionalities, from real-time economic impact analysis to detailed regulatory compliance checks. This integration enables seamless and efficient management of complex risk scenarios, allowing banks, insurance companies, family offices, and wealth managers to perform robust, precise stress tests swiftly.

The architecture of SCENARIO X’s platform is designed for adaptability and scalability, supporting institutions in navigating the volatile financial landscape. Each module within our system is crafted to interact fluidly, ensuring that changes in one area, like market risk assessment, automatically update related areas such as credit risk or liquidity forecasts. This holistic approach not only saves time but also enhances the accuracy of risk assessments, empowering clients with the confidence to make informed decisions swiftly.

WHY WE ARE SO DIFFERENT

HOW IT WORKS?

Comprehensive Workflow automation

From data input to sophisticated risk assessments, the entire process is streamlined through modules like Asset and Liability Modelling, Risk analytics and simulation, Capital optimisation, which feed into an overarching system that automates and simplifies complex processes.

What Sets us apart

Visualisation / Ui

Our modules

Roll forward

expansion

Design

Asset analytics

Liability analytics

equity analytics

income analytics

OpEx analytics

Tax analytics

Market risk analytics

counterparty risk analytics

credit risk analytics

operational risk analytics

B/s and P&L analytics

Liquidity analytics

Capital analytics

Management action

Our modules

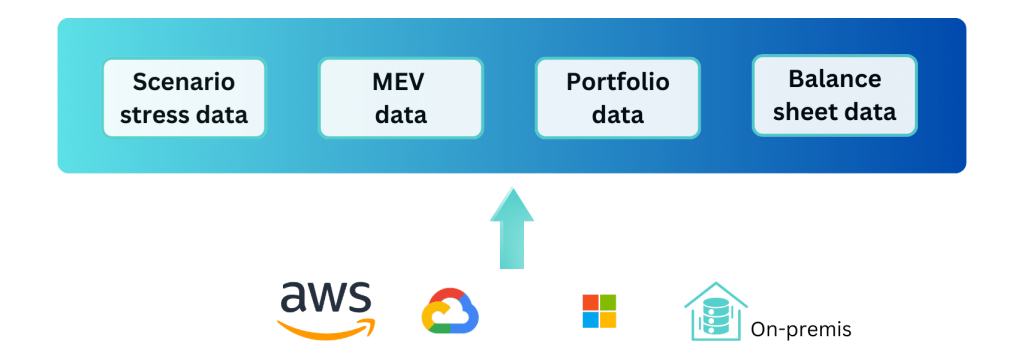

inside the cloud

DATA sources

Scenario Stress data

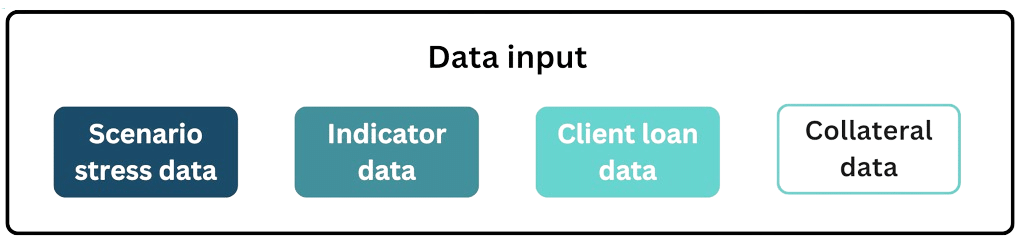

Client loan data

Indicator data

Collateral data

DATA sources

Scenario Stress data

Client loan data

Indicator data

Collateral data

SCENARIO

The Scenario Module in Scenario X employs advanced AI techniques to design, expand, and roll forward scenarios, providing a robust framework for financial institutions. This module enables proactive risk mitigation and strategic decision-making by offering tools for rapid scenario expansion and in-depth analysis of potential market conditions. It is instrumental in optimizing balance sheet management strategies, ensuring market resilience, and navigating evolving regulatory landscapes effectively.

PPNR

Scenario X’s PPNR Module integrates comprehensive data analysis across asset, liability, equity, income, opex, and tax considerations to provide forward-looking revenue projections essential for stress testing. This module aids banks in strategic planning and capital allocation while ensuring regulatory compliance. It prepares financial institutions for potential downturns by offering a detailed forecast of financial health under various stress scenarios, crucial for proactive decision-making and strategic resilience.

RISK

The Risk Module in Scenario X offers an integrated approach to managing various financial risks including market, counterparty, credit, and operating risks. By synthesizing data from related risk modules, it provides financial institutions with the tools needed to identify, assess, and prioritize risks effectively. This module supports continuous risk monitoring and alignment with the institution’s risk appetite and business goals, ensuring regulatory compliance and maintaining financial stability.

CONSOLE

Scenario X’s Console Module serves as a central hub for critical financial data and insights, pulling together information from various modules including Balance Sheet, Profit & Loss, Liquidity, Capital, and Management Actions. This integrated dashboard streamlines the analysis and decision-making process, enabling financial institutions to access consolidated views of their financial status and operational health, thereby enhancing efficiency and strategic oversight.

SCENARIO

The Scenario Module employs advanced ML and QML algorithms to design, expand, and roll forward scenarios. This module enables proactive risk mitigation and strategic decision-making by offering tools for rapid scenario expansion and in-depth analysis of potential market conditions. It is instrumental in assessing potential trend of market, understanding correlation effect between different market variables.

PPNR

The Pre-Provision Net Revenue Module analyses assets, liabilities, equity, income, operating expenses, and tax considerations to project revenue. It covers key metrics such as asset and liability volume, NII, NFI, FTP, and margin projections. This aids banks in strategic planning while ensuring regulatory compliance. The module prepares institutions for potential downturns, crucial for proactive decision-making and strategic resilience.

RISK

The Risk Module in SCENARIO X provides a comprehensive solution for managing a wide range of financial risks, including market, counterparty, credit, and operational risks. This module enables financial institutions to estimate and forecast key metrics such as Expected Credit Losses (ECL), Value at Risk (VaR), and Risk-Weighted Assets (RWA) according to predefined scenarios. It supports continuous risk monitoring, ensuring not only regulatory compliance but also alignment with the institution’s risk appetite and business objectives.

CONSOLE

Scenario X’s Console Module serves as a central hub for critical financial data and insights, pulling together information from various modules including Balance Sheet, Profit & Loss, Liquidity, Capital, and Management Actions. This integrated dashboard streamlines the analysis and decision-making process, enabling financial institutions to access consolidated views of their financial status and operational health, thereby enhancing efficiency and strategic oversight.