Our purpose

Our Mission

Stabilise the financial industry by transforming uncertainty into certainty.

Our Vision

To equip financial institutions with the tools to make every crisis an opportunity.

Our Approach

Leverage data to create scenarios that mitigate risk and drive growth.

SCENARIO

PPNR

Scenario X’s PPNR Module

synthesizes data for revenue

projections, aiding strategic

planning and regulatory

compliance.

RISK

Scenario X’s Risk Module

assesses and manages

market, counterparty, credit,

and operating risks for

financial stability.

CONSOLE

Scenario X’s Console Module

aggregates financial data for

streamlined analysis and

decision-making.

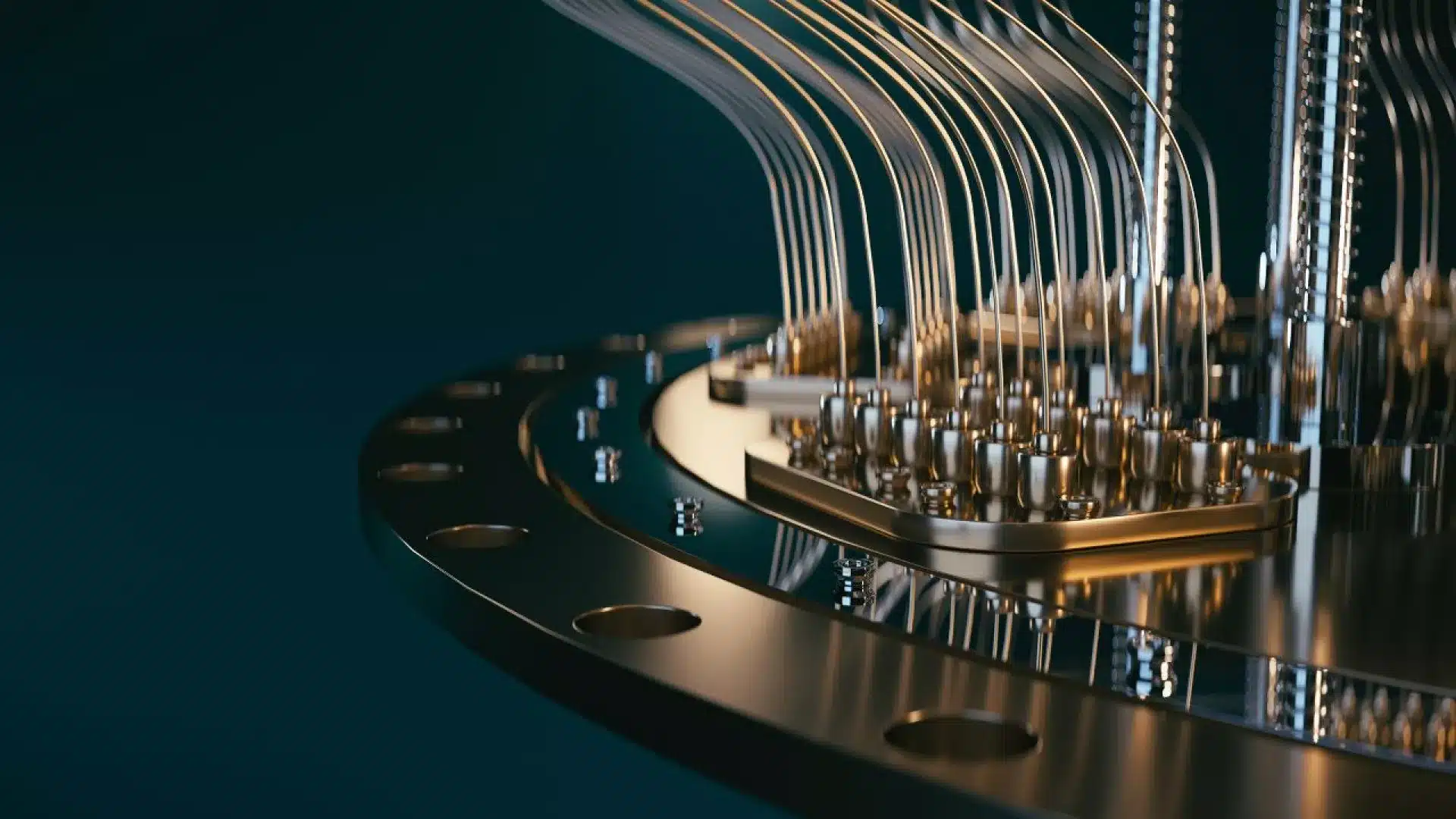

Accelerate your analytics with our quantum use-cases

The integration of quantum computing, AI, and classical computing into hybrid cloud

workflows will drive the most significant computing revolution in 60 years. Quantumpowered workflows will radically reshape how enterprises work.

Risk metric calculation monte carlo simulation IBM quantum Decade.

Quantum Computing

The future of Business

Imagine being able to make calculations that reveal dynamic arbitrage possibilities that competitors are unable to see. Beyond that, greater compliance, employing behavioral data to enhance customer engagement, and faster reaction to market volatility are some of the specific benefits we expect quantum computing to deliver.

While broad commercial applications may remain several years away, quantum computing is expected to produce breakthrough products and services likely to successfully solve very specific business problems within three-to-five years. (IBM – Yndurain et al 20XX page 1- Quantum & Finance use-cases)

How Industries Benefit

Empowering Independent Wealth Advisors with Scenario X

Streamline Wealth Management with Cutting-Edge Analytical Tools

- Aggregate and analyse diverse asset classes to optimize investment strategies in real-time.

- Automate compliance reporting, reducing manual intervention and errors.

- Enhance client reporting with customized insights into portfolio performance and risk.

- Leverage predictive analytics to identify investment opportunities and potential risks.

- Streamline operations through integration with existing financial planning tools and databases.

- Predictive financial modelling to forecast asset growth and identify potential downturns in individual asset classes.

- Enhanced data visualization tools allow wealth managers to present complex financial data in understandable formats to clients.

- Automated alert systems to notify managers of significant market changes that could impact client portfolios.

Harnessing the Power of Scenario X

Optimizing Wealth Management with Advanced Data Integration and Analytics

- Consolidate financial data from various family entities to provide a holistic view of assets.

- Enhance client reporting with customized insights into portfolio performance and risk.

- Leverage predictive analytics to identify investment opportunities and potential risks.

- Streamline operations through integration with existing financial planning tools and databases.

- Predictive financial modelling to forecast asset growth and identify potential downturns in individual asset classes.

- Enhanced data visualization tools allow wealth managers to present complex financial data in understandable formats to clients.

- Automated alert systems to notify managers of significant market changes that could impact client portfolios.

Enhancing Market Strategies with Scenario X

Leverage Real-Time Data and Predictive Analytics for Competitive Trading

- Access real-time market data and advanced analytics to inform trading decisions.

- Utilize AI-driven insights for predictive market movements and trend analysis.

- Automate trade execution to capitalize on opportunities faster than market competitors.

- Perform high-frequency trading with support from powerful computing capabilities.

- Monitor and manage risk on each trade through advanced risk assessment tools.

- Algorithmic trading strategies can be developed and refined using historical data analysis and real-time market conditions.

- Market sentiment analysis using natural language processing to gauge market mood from news feeds and social media.

- Enhanced liquidity management tools to optimize asset purchase and sale timings based on predictive cash flow models.

Transforming Risk Management with Scenario X

Drive Efficient Compliance and Client-Centric Solutions through Technology

- Integrate risk assessment models to calculate premiums based on predictive risk insights.

- Analyse historical claims data to identify patterns and potential fraud.

- Enhance actuarial modelling with AI to improve accuracy in life expectancy and liability predictions.

- Streamline claims processing through automated data ingestion and processing.

- Conduct market analysis to adjust insurance product offerings based on emerging trends.

- Tailored insurance products developed through machine learning models predicting customer preferences and needs.

- Automated regulatory compliance tracking ensures that new regulations are quickly incorporated into risk and operational models.

- Optimization of reinsurance strategies through simulations of various risk scenarios and their financial impacts.

et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore

et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

Empowering Independent Wealth Advisors with Scenario X

Streamline Wealth Management with Cutting-Edge Analytical Tools

- Aggregate and analyse diverse asset classes to optimize investment strategies in real-time.

- Automate compliance reporting, reducing manual intervention and errors.

- Enhance client reporting with customized insights into portfolio performance and risk.

- Leverage predictive analytics to identify investment opportunities and potential risks.

- Streamline operations through integration with existing financial planning tools and databases.

- Predictive financial modelling to forecast asset growth and identify potential downturns in individual asset classes.

- Enhanced data visualization tools allow wealth managers to present complex financial data in understandable formats to clients.

- Automated alert systems to notify managers of significant market changes that could impact client portfolios.

Harnessing the Power of Scenario X

Optimizing Wealth Management with Advanced Data Integration and Analytics

- Consolidate financial data from various family entities to provide a holistic view of assets.

- Enhance client reporting with customized insights into portfolio performance and risk.

- Leverage predictive analytics to identify investment opportunities and potential risks.

- Streamline operations through integration with existing financial planning tools and databases.

- Predictive financial modelling to forecast asset growth and identify potential downturns in individual asset classes.

- Enhanced data visualization tools allow wealth managers to present complex financial data in understandable formats to clients.

- Automated alert systems to notify managers of significant market changes that could impact client portfolios.

Enhancing Market Strategies with Scenario X

Leverage Real-Time Data and Predictive Analytics for Competitive Trading

- Access real-time market data and advanced analytics to inform trading decisions.

- Utilize AI-driven insights for predictive market movements and trend analysis.

- Automate trade execution to capitalize on opportunities faster than market competitors.

- Perform high-frequency trading with support from powerful computing capabilities.

- Monitor and manage risk on each trade through advanced risk assessment tools.

- Algorithmic trading strategies can be developed and refined using historical data analysis and real-time market conditions.

- Market sentiment analysis using natural language processing to gauge market mood from news feeds and social media.

- Enhanced liquidity management tools to optimize asset purchase and sale timings based on predictive cash flow models.

Transforming Risk Management with Scenario X

Drive Efficient Compliance and Client-Centric Solutions through Technology

- Integrate risk assessment models to calculate premiums based on predictive risk insights.

- Analyse historical claims data to identify patterns and potential fraud.

- Enhance actuarial modelling with AI to improve accuracy in life expectancy and liability predictions.

- Streamline claims processing through automated data ingestion and processing.

- Conduct market analysis to adjust insurance product offerings based on emerging trends.

- Tailored insurance products developed through machine learning models predicting customer preferences and needs.

- Automated regulatory compliance tracking ensures that new regulations are quickly incorporated into risk and operational models.

- Optimization of reinsurance strategies through simulations of various risk scenarios and their financial impacts.

Revolutionizing Banking Operations with Scenario X

Advanced Analytics and Compliance Automation to Fortify Financial Services

- Integrate risk assessment models to calculate premiums based on predictive risk insights.

- Analyse historical claims data to identify patterns and potential fraud.

- Enhance actuarial modelling with AI to improve accuracy in life expectancy and liability predictions.

- Streamline claims processing through automated data ingestion and processing.

- Conduct market analysis to adjust insurance product offerings based on emerging trends.

- Tailored insurance products developed through machine learning models predicting customer preferences and needs.

- Automated regulatory compliance tracking ensures that new regulations are quickly incorporated into risk and operational models.

- Optimization of reinsurance strategies through simulations of various risk scenarios and their financial impacts.

How users benefit (Banks)

Revolutionizing Banking Operations with Scenario X

Advanced Analytics and Compliance Automation to Fortify Financial Services

- Perform stress tests using advanced scenario models to comply with regulatory requirements.

- Optimize liquidity management with predictive forecasting of cash flows and obligations.

- Enhance credit risk analysis by integrating external and internal data sources for a comprehensive risk profile.

- Automate loan underwriting processes to improve efficiency and decision accuracy.

- Develop personalized banking products through insights derived from customer data analytics.

- Fraud detection enhancements using AI to analyse transaction patterns and flag unusual activities.

- Customer retention models predict and mitigate factors leading to customer churn based on behavioural analytics.

- Digital transformation facilitation by integrating AI with digital banking services to enhance user experience and operational efficiency.

Explore the SCENARIO X think piece

Blog

Our associates